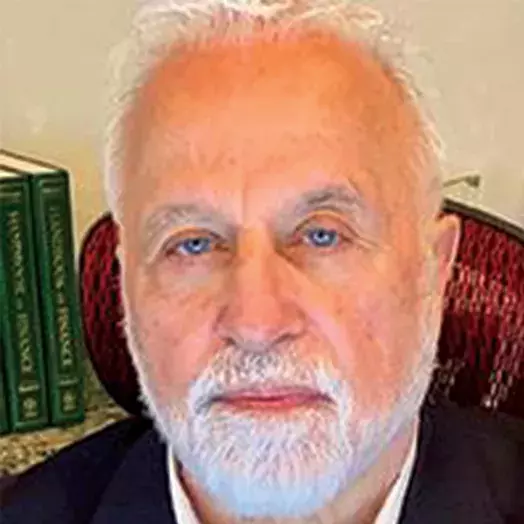

Frank Fabozzi is among the most prolific authors in financial economics, and his work helped prepare thousands of business students for careers as bond traders, bankers, and money managers.

Fabozzi quietly keeps writing the book on financial economics

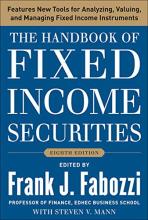

To say Frank Fabozzi wrote the book on financial economics would be, at best, an understatement. While not necessarily a household name outside of business or academia, Fabozzi is among the most prolific authors in economics, having published more the 120 books on the subject including The Handbook of Fixed Incomes and Securities, which many consider the “bible” for fixed income investing. The Handbook of Fixed Incomes and Securities was first published in 1983 and remains in print. In 2013, Business Insider named it one of the “most important finance books ever written.”

A 1999 Bloomberg Magazine cover story entitled "The Boswell of Bonds” compared Fabozzi’s knowledge and impact to work of famed historian John Boswell. The feature explains how Fabozzi built a “bond market empire built on books,” by helping prepare thousands of newly minted business students for careers as bond traders, bankers, and money managers.

“In about 1978 or ’79, I started writing books, and I wrote enough of them where, in a certain year, I decided to start my own publishing company,” Fabozzi chuckled. “There's really no money in books. I really do books now because it's fun, it's enjoyable.”

Fabozzi recounted an early collaboration with Franco Modigliani, who in 1985 won the Nobel Prize in Economics for his work on practical applications of economic theory. Fabozzi said he was on a consulting assignment in the Middle East when a hotel porter tracked him down for an urgent call.

“Modigliani said, ‘The book reviewer is complaining that we don't cite a lot of things that we introduced in the book,’” recalled Fabozzi. “And I told him, ‘Well, you know, it's all new stuff that's not going be in [current] textbooks.’ He said, ‘Okay, thank you,’ and he hung up.”

In addition to books, Fabozzi is also the longtime editor of the Journal of Portfolio Management, a leading academic journal for finance and investing research, and co-editor of the recently launched Journal of Financial Data Science. He’s also authored hundreds of research papers appearing in the Journal of Finance, Journal of Financial and Quantitative Analysis, Review of Finance, Operations Research, Econometric Theory, and Journal of Economic Dynamics and Control. Among his research works, Fabozzi is co-creator of the Kalotay-Williams-Fabozzi (KWF) short-rate model used to evaluate interest rate derivatives over time. In his non-academic roles, Fabozzi is a longtime member of the fixed-income fund board of directors for BlackRock Inc., which is the world’s asset manager with an estimated $8.5 trillion under management.

Fabozzi’s 53-year career in academia started in 1970 at City College of New York where he earned both a bachelor’s, master’s, and doctorate in economics. He earned his bachelor’s and master’s degrees concurrently before completing his PhD at the Graduate Center at CUNY. During this time, he also started teaching. Over the decades, he’s held faculty teaching positions at EDHEC Business School, Yale, MIT, Princeton, Carnegie Mellon, and New York University, before coming to Johns Hopkins Carey Business School in 2021.

Fabozzi’s illustrious academic credentials are noteworthy, but his students say they value most his insightful teaching and open approach in the classroom. For Victor Melfa (Finance ’23), the opportunity to learn from Fabozzi was the critical deciding factor in choosing Carey Business School. Melfa, a partner and portfolio manager at Factor Investing Group, says he and his mentor were “blown away” when they learned Fabozzi had joined the faculty at Johns Hopkins Carey Business School. In fact, it sealed the deal.

“It’s an amazing opportunity for prospective students or students at Hopkins to learn directly from someone who has written with Nobel laureates like Harry Markowitz, Robert Shiller, Robert Engle, and Franco Modigliani,” he said.

Melfa appreciated how Fabozzi made his classes interesting and engaging for students of all levels of experience.

What to Read Next

career outcomes

Bridging financial gaps: An alumnus’ mission to break down financial inequalities“As a practitioner, I was really impressed with how he was able to tailor and package the material that made me understand derivatives in a way that I hadn't before,” said Melfa.

Nick Guido, who is currently working on an MS in Finance, echoed Melfa’s sentiments. “I had heard of [Professor Fabozzi] before coming to Carey because he's an icon in the fixed income world. You know, meeting him and working with him just was totally different. It was more than I had expected. So, it was definitely a highlight of my experience at Carey.”

Guido took both corporate finance and derivatives courses from Professor Fabozzi. “If the school had him teaching more courses, I would take them,” he said. “I look out there actively for his courses, and I talk with him on the side, I ask him, you know, ‘What courses are you teaching?’”