Consumers and businesses stacks of cash and continued reopening will cushion the Fed’s blows

The U.S. economy may have already entered a recession, but it may not be as dire as what some economists have predicted, even after the Fed raised interest rates on July 27 by a substantial three-quarters of a point.

The increase marked the third interest rate hike aimed at curbing inflation, bringing the policy rate to a range of 2.25 percent to 2.5 percent - the highest level since 2018.

Johns Hopkins Carey Business School Associate Professor Alessandro Rebucci, PhD, is optimistic that the Fed interest rate hikes to tame inflation, a quickly slowing Chinese economy, and the troubled Eurozone economies will not drag the U.S. down into a severe recession.

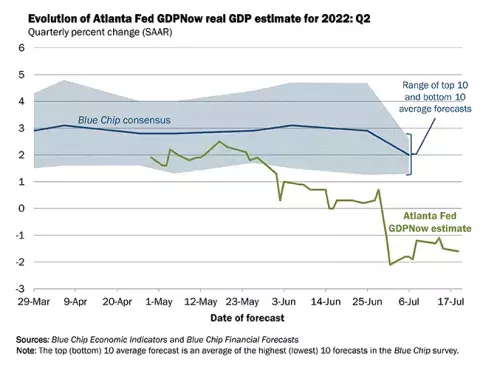

He’s expecting that the U.S. will experience a “mild recession.” A recession, Rebucci says, is defined as two consecutive quarters of negative gross domestic product growth. U.S. GDP was negative in the first quarter of 2022 because of falling exports, particularly to China, and it has decelerated further, according to the Atlanta Fed GDP Nowcast.

Good news

Professor Rebucci says there are at least three reasons to be optimistic about the U.S. economy.

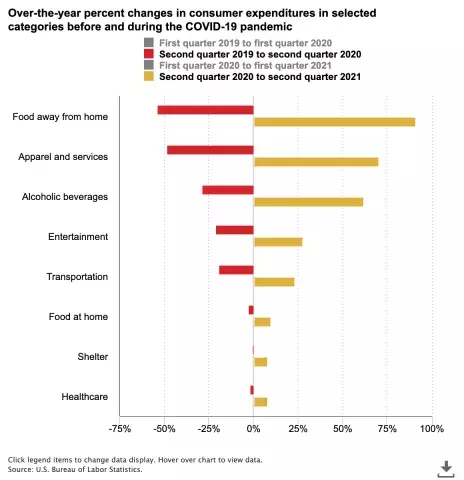

Consumers, albeit more pessimistic, are still spending and they are the drivers of U.S. economy. Rebucci adds that households still have 2.5 trillion cushion of savings accumulated during the height of the pandemic. According to the U.S. Bureau of Labor Statistics, the personal saving rate averaged 7.5 percent from 2015-2019, before the pandemic. During the pandemic, it averaged twice as much, allowing consumers to pay down debt and prepare for the rainy days that are coming. All this, Rebucci says, means households will be able to withstand the coming slowdown much better than in previous recessions.

The same goes for businesses. Firms sits on large cash balances and currently don’t depend on credit or the stock market to finance their expansion plans. CEO surveys show that executives are more worried about the broader economy than their own business, suggesting that they are concerned about inflation and the Fed’s response, but are not seeing clouds over their horizons.

Unlike China, the U.S. economy continues to reopen and stays open despite a new COVID-wave buffeting the country, including the White House. Full resumption of economic activity in the service industries will provide support to any employment losses in sectors more exposed to slowing international trade and the tapering of expenditures on goods during the pandemic.

Mandated lockdowns, mass testing, quarantines, and border closures forced major big-box retailers, including Walmart Inc. and Target Corp., to bulk up on inventory last year to avoid lengthy shipping delays. Both corporations are now sitting on inventories of $45 billion, up 26 percent from a year ago. A welcome sign normalcy is returning, and good price will soon start to fall, without need a major recession.

“The risk of a major recession may be already behind us. The economy is already slowing, energy prices and shipping costs are falling and, and barring another round of shutdowns in China, supply chains are slowly normalizing or adapting to the endemic and geopolitically fragmented new world economy.”

Alessandro Rebucci, Associate Professor Carey Business School

While there are still pockets of weaknesses in the service industry, there are plenty of signs of improvement.

Travel and hotel stays have normalized. The TSA statistics show that domestic travel during the 2022 4th of July holiday got close to pre-pandemic levels. More than 2 million travelers passed through airports compared to 2.75 million in 2019 and just 175,000 in 2020. Times Square, the official website, reports that 353,576 visited the heart of Times Square daily this week. A typical day before the pandemic averaged 360,000 people a day. Compare that to 2020, when only 125,000 people visited Times Square daily.

Markets are currently pricing another 75-basis-point hike, bringing the benchmark rate about two-thirds of the way where they and the Fed currently expect it to peak in 2023. In other words, Rebucci says, the end of the tightening cycle is in sight and the risk of an overreaction to the Fed’s medicine is diminishing. The economy has not tanked yet, and is unlikely to do so at this point in the tightening cycle.

“The economy is already slowing, energy prices are falling, and barring another round of shutdowns in China, supply chains are slowly normalizing or adapting to the endemic and geopolitically fragmented new world economy,” he explains.

Major risks

What to Read Next

Article

What You Need to Know About SWIFT and Economic SanctionsThe major risks lie not necessarily in U.S., but across the world. Rebucci broke down three key areas to watch as we navigate through 2022.

The Eurozone is just starting the tightening cycle and may have to stop right off the bat, due to political instability in Italy---its third largest economy threatening the monetary union once again.

European Central Bank President Christine Lagarde announced on July 21 a first-rate increase, the first time in 11 years, bringing the policy rate to zero, and a new bod purchase program to protect member states under speculative attaches on their sovereign debt. The ECB, which unlike the Fed could focus only on inflation, has set itself up to pursue two objectives that are difficult to reconcile: tightening monetary policy to tame inflation, and loosening it to prevent that tighter monetary policy damage to the monetary union. The risk of a second Eurozone crisis is material, and that would put headwinds on the U.S. economy even though it would not drag it down.

China: China may be on one of the biggest factors yet. When COVID-19 cases go up, as they will do again, the Chinese government will shut down parts of the country, including the financial center of Shanghai and export hubs like Shenzhen and Hong Kong Province of China.

“COVID will come out of the box again, and shutdowns in China are quite likely,” Rebucci says. “A shutdown in China means major disruptions to the supply chain, and more persistent U.S. inflation.”

War in Ukraine: One of the biggest factors in the global economy will be how countries adjust to the war in Ukraine going forward. The unpredictability is having a larger impact than first thought.

Russia’s invasion of Ukraine has led to numerous global supply chain issues including food staples like wheat and energy.