The Johns Hopkins Carey Business School’s Student-Managed Investment Fund provides MBAs and finance students the opportunity to manage real money in the real world.

Student-managed investment fund helps Carey students learn by doing

What to Read Next

student experience

Johns Hopkins Carey Business School MBA Experiential Learning Curriculum Recognized with Annual Innovation AwardMBA candidate Michelle Nezianya serves as risk manager for the course. Before beginning her studies, she worked in investments for one of the largest commercial banks in Nigeria. As a risk manager, she and her team review recommendations made by the investments team. They review the impact on the portfolio, the correlation with other assets, and other economic aspects. In addition to the risk team review, safeguards are in place to ensure trades can only be made by agreement and approval of the investment fund members.

“What I really enjoy most is getting that practical hands-on experience, especially as I eventually plan to invest for myself,” Nezianya said.

After graduation, Nezianya plans to join Amazon as a finance manager.

“I think my experience would kind of mirror the experience of most of the people in the class. We find it's really valuable that we can actually practice some of the things that we've learned,” said Nezianya.

There is an adage that says, “Experience is the best teacher.” Experience is what the Johns Hopkins Carey Business School’s Student-Managed Investment Fund aims to provide by allowing MBAs and finance students to manage real money in the real world. So far, the experience is paying off. Since the fund’s launch in 2023, the student-managed fund has consistently outperformed the Vanguard Total Stock Market index by several percentage points, which the students use as a benchmark for success.

Starting with a gift

The idea for the Student-Managed Investment Fund started with a gift from Hao Yu, a member of Carey Business School’s inaugural full-time MBA class. In giving back to his alma mater, Yu wanted to create an experiential learning opportunity for students pursuing finance. His donation was the initial seed money for creating a $300,000 investment fund. With the fund in place, Carey’s faculty created a single-credit per term course, offered year-round in which students meet to manage assets and make transaction decisions. The course is open to full-time MBA and MS Finance students, but students need to apply to be admitted and are selected by a faculty oversight committee. The funds are held by Northern Trust brokerage, which handles large institutional investors.

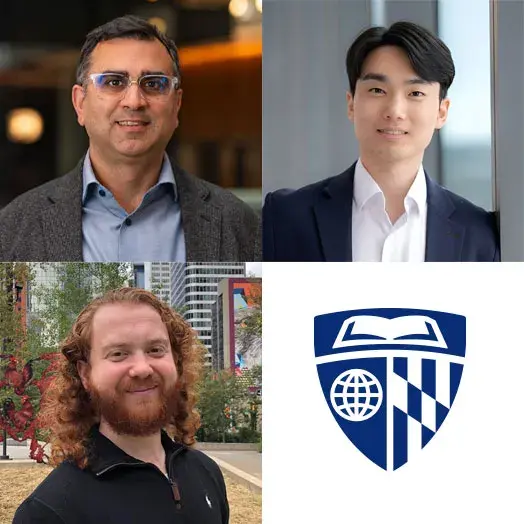

“The structure of the class is not lecture-based. It's more experience-based,” said Senior Lecturer Xiaohua Hu, who leads the Student-Managed Fund course. “It's different from a traditional course in the sense that it basically is trying to bring many different aspects of managing real money together through experience. They get to learn, and they basically get a chance to be job-ready on day one after they graduate.”

While students don’t sit for lectures, Hu says students do get to meet with practicing hedge fund and investment managers, and there is plenty of time to discuss trades and investment strategies.

“The course is designed to bring many different aspects of managing money on behalf of the institution and bring all those different aspects of operating a fund together in this class,” added Hu.

Ready from day one

Luke Hartline, a 2024 MBA candidate, was among the first students to sign up for the Student-Managed Investment Fund and serves as chair of the group’s investment committee. Before studying at Carey, Hartline worked in the pharmaceutical industry but decided to pivot to finance. He says the Student-Managed Investment Fund helped build his finance acumen. He will be joining DC Advisory Investment Bank after graduation in May.

As Hartline explains, students join research teams that evaluate stock and funds covering a variety of business sectors. They look to diversify investments following the Treynor-Black model, which is a technique for determining the optimal mix of assets. The model focuses on maximizing the portfolio’s Sharpe ratio, which compares the return on an investment with its risk. The students also discuss environmental, social, and governance principles, known collectively as ESG, and other factors in making recommendations. A student risk team further evaluates the decision-making process.